18 Jun Tip Tuesday

Welcome to Eagle & Fein, P.C.

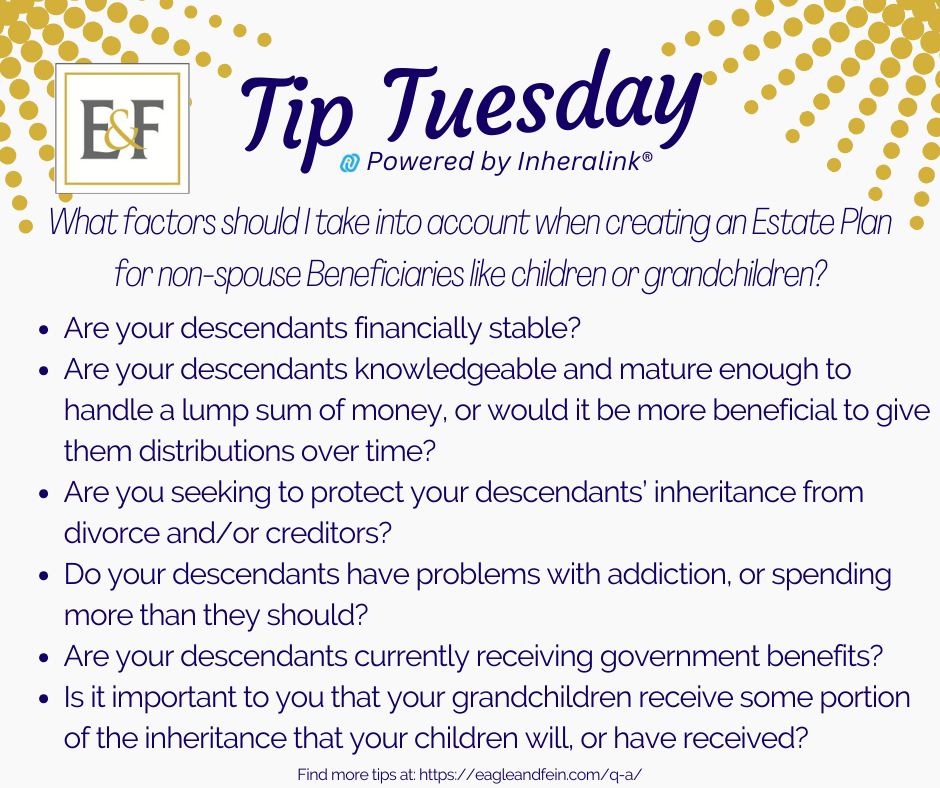

When it comes to creating an estate plan for your loved ones, especially non-spouse beneficiaries like children or grandchildren, there are several important factors to consider.

First and foremost, it’s crucial to clearly outline your wishes and intentions in a legally binding document such as a will or trust. This will ensure that your assets are distributed according to your wishes and that your loved ones are taken care of in the way you desire.

Secondly, consider the age and financial responsibility of your beneficiaries. For minor children or young grandchildren, you may need to designate a guardian or establish a trust to manage their inheritance until they reach a certain age or level of maturity. For adult beneficiaries, think about their financial literacy and ability to handle a large sum of money.

Additionally, take into account any special needs or circumstances of your beneficiaries. If any of your children or grandchildren have disabilities, you may need to set up a special needs trust to ensure they continue to receive necessary care and support.

Lastly, regularly review and update your estate plan as your circumstances change. Life events such as marriages, divorces, births, and deaths can all impact your estate plan, so make sure to revisit it periodically to ensure it still reflects your wishes.

By carefully considering these factors and working with a qualified estate planning attorney, you can create a comprehensive plan that provides for your non-spouse beneficiaries in the way you intend. #EstatePlanning #Beneficiaries #LegacyPlanning

Is there a question you would like to have answered? Let us know!